As one source of funding for transportation projects, the federal government and all states place a tax on fuel purchases. However, at the local and regional level, authorization and use of fuel taxes vary widely. In Montana, for example, state law has authorized a local option gas tax since 1979, but it has not been utilized. That changed in June 2020 when voters in Missoula County approved a historic local option gas tax, marking the first time any county in the state has done so.

The success of the referendum in Missoula County may generate increased interest in this funding source by other counties. In addition, there are ongoing discussions at the state and national level about the viability of fuel taxes as a sustainable funding resource in response to recent reductions in fuel consumption and in the context of the upcoming reauthorization of federal transportation legislation. In light of all these factors, WTI recently completed a study to consider the revenues that could be raised for roads, highways, streets, and bridges throughout Montana by imposing the local option gas tax.

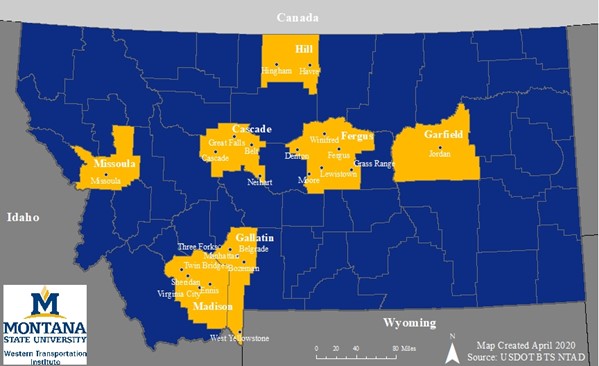

“An Evaluation of the Montana Local Option Motor Fuel Excise Tax” summarizes the recent history of federal and state fuel taxes, with a focus on the State of Montana and Missoula County. The subsequent analysis assesses fuel tax revenues and expenditures for roads, highways, streets, and bridges for seven Montana counties (Cascade, Fergus, Gallatin, Garfield, Hill, Madison, and Missoula). Several findings provide insights related to the contribution of fuel taxes to transportation expenditures; for example, neither state gas nor diesel taxes have kept up with inflation, and fuel tax revenues cover a relatively small share (7%-10% on average) of the roadway, highway, street, and bridge expenditures across the seven Montana counties in the study area. Moreover, the 2 cent/gallon local option tax is estimated to increase an average motorist’s costs by a relatively modest $8 – $27 per year. The full report, authored by Principal Investigator Andrea Hamre, is available on the project webpage of the WTI website.